Jerry Reinsdorf stands as one of the most successful and controversial owners in professional sports history, commanding an estimated net worth of $2.2 billion as of 2026. The 90-year-old businessman transformed from a humble tax attorney into a dual-franchise sports mogul who has presided over both glorious championships and historic failures across his nearly four-decade tenure owning the Chicago Bulls and Chicago White Sox.

His journey from Brooklyn’s working-class neighborhoods to the pinnacle of American sports ownership represents a masterclass in strategic investing, real estate acumen, and calculated risk-taking. Yet his legacy remains deeply polarizing, celebrated for building championship dynasties while simultaneously criticized for breaking them apart, praised for business savvy while condemned for perceived cheapness, and honored in halls of fame while booed by his own teams’ fans.

This comprehensive examination explores every facet of Jerry Reinsdorf’s net worth, from his initial fortune in real estate to his current status as one of sports’ most powerful figures, the controversies that have defined his tenure, and the succession plans that will shape Chicago sports for generations to come.

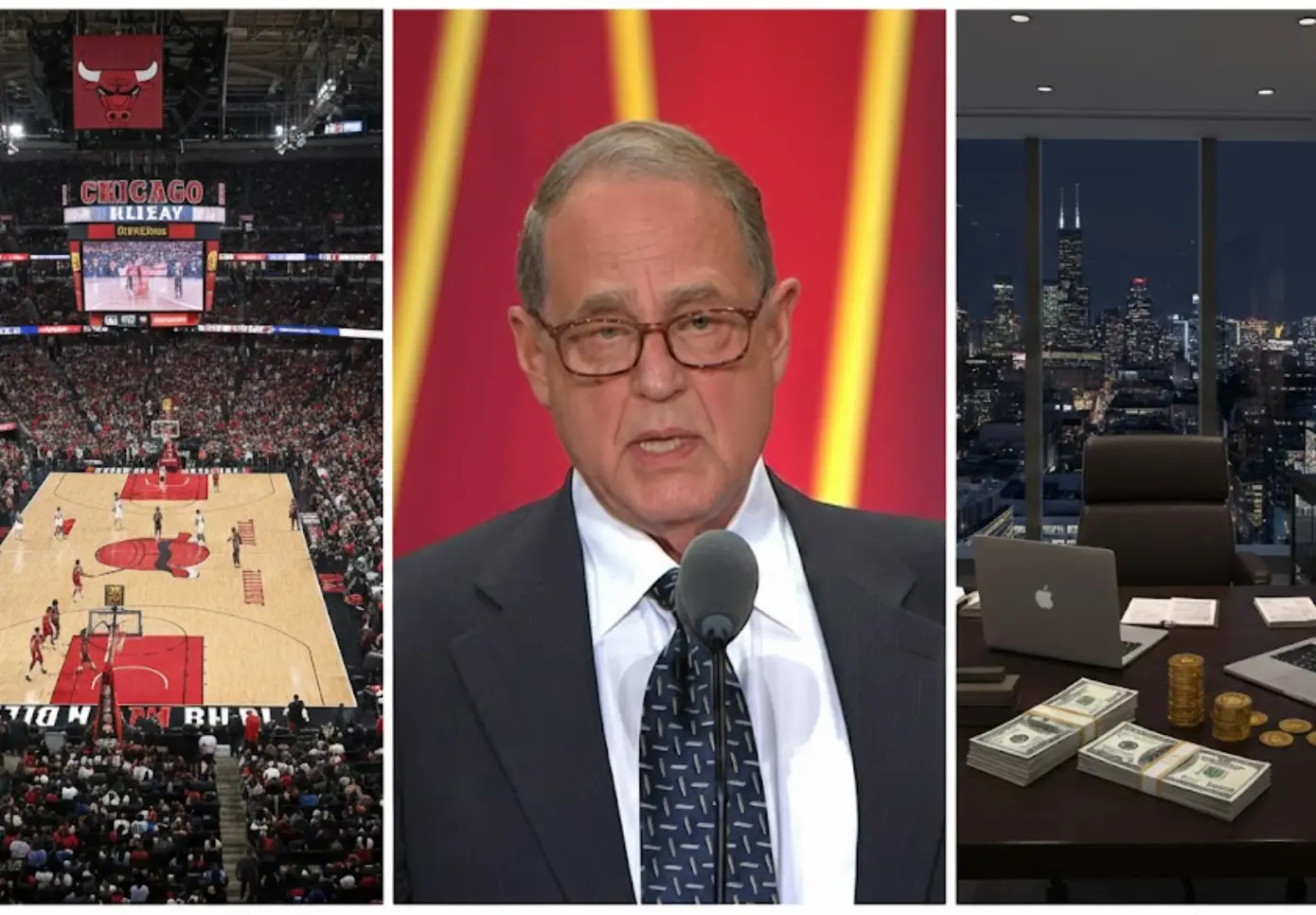

Jerry Reinsdorf Net Worth in 2026

As of 2026, Jerry Reinsdorf’s net worth stands at approximately $2.2 billion, making him one of the wealthiest team owners in professional sports. This fortune places him at #1,748 on Forbes’ global billionaires list and #582 among American billionaires.

Net worth breakdown by source:

- Chicago Bulls ownership (40% stake): The Bulls are currently valued at $5.8 billion, making Reinsdorf’s 40% controlling interest worth approximately $2.3 billion

- Chicago White Sox ownership (majority stake): The White Sox are valued at approximately $1.8-1.9 billion, with Reinsdorf’s controlling interest worth $900 million-$1 billion

- Real estate holdings: Estimated at $200-300 million

- Other investments and assets: Approximately $100-200 million

Historical net worth progression:

- 2020: $1.5 billion

- 2022: $2.0 billion

- 2024: $2.2 billion (Forbes estimate)

- 2026: $2.2 billion (current estimate)

Reinsdorf’s wealth has grown substantially due to the explosive appreciation of NBA and MLB franchise values. The Bulls, which he purchased for $16 million in 1985, have appreciated approximately 36,000% in value. The White Sox, acquired for $19 million in 1981, have grown about 9,000% in value.

Despite this immense paper wealth, Reinsdorf has developed a reputation as one of the most frugal owners in professional sports, earning descriptions as a “cheapskate” from publications like Time magazine and drawing criticism for his reluctance to spend on player salaries relative to his teams’ market size.

Who Is Jerry Reinsdorf?

Jerry Michael Reinsdorf was born on February 25, 1936, in Brooklyn, New York, to a Jewish family. His father worked as a sewing machine salesman, providing the family with a modest middle-class existence in one of Brooklyn’s working-class neighborhoods.

Personal profile:

- Full name: Jerry Michael Reinsdorf

- Date of birth: February 25, 1936

- Age: 90 years old (as of 2026)

- Place of birth: Brooklyn, New York, USA

- Nationality: American

- Religion: Jewish

- Education: Bachelor’s degree from George Washington University; Law degree from Northwestern University School of Law (1960)

- Profession: Sports executive, businessman, lawyer, certified public accountant

Early Life and Formative Experiences

Reinsdorf attended Erasmus Hall High School in Brooklyn, where he was present for one of baseball’s most historic moments. On April 15, 1947, young Reinsdorf was in the stands at Ebbets Field when Jackie Robinson broke Major League Baseball’s color barrier by debuting for the Brooklyn Dodgers. This experience would profoundly shape his lifelong passion for baseball.

After high school, Reinsdorf earned his bachelor’s degree from George Washington University, where he became a member of the Alpha Epsilon Pi fraternity. In 1957, he moved to Chicago to pursue his professional career.

Reinsdorf demonstrated exceptional academic and professional versatility early in his career, becoming a certified public accountant, lawyer, registered mortgage underwriter, and certified review appraiser. He leveraged a full scholarship offer from the prestigious University of Chicago Law School to negotiate a scholarship from Northwestern University School of Law, graduating in 1960.

Early Career as Tax Attorney

After graduating from Northwestern, Reinsdorf’s first job was as a tax attorney with the Internal Revenue Service (IRS). In a twist of fate that foreshadowed his future, his very first case involved the tax delinquency of Bill Veeck, who at the time owned the Chicago White Sox, the same team Reinsdorf would purchase two decades later.

In 1964, Reinsdorf went into private practice, developing a specialty in real estate partnership tax shelters. His expertise in this complex area of tax law would become the foundation of his initial fortune.

Personal Life

In 1956, while both were students at George Washington University, Reinsdorf married Martyl Rifkin (March 4, 1936 – June 28, 2021). Martyl was born in Denver, Colorado, to Milton and Vivette Rifkin (née Ravel). The Rifkin family moved to Chicago in 1944, where Martyl attended Morgan Park High School.

Their marriage lasted 65 years until Martyl’s death on June 28, 2021. The couple had four children:

- Susan Reinsdorf

- David Reinsdorf

- Michael Reinsdorf (current president and COO of the Chicago Bulls)

- Jonathan Reinsdorf

The couple also had eight grandchildren, with Jerry expressing hopes that future generations of Reinsdorfs will continue owning the Bulls.

Building the Real Estate Fortune

Jerry Reinsdorf made his initial fortune in real estate through brilliant exploitation of a 1978 Supreme Court decision that created lucrative tax advantages for property investors.

The Frank Lyon Decision

Reinsdorf capitalized on the Frank Lyon Co. v. United States Supreme Court decision, which allowed economic owners of real property to sell property and lease it back while transferring the tax deduction for depreciation to the title owner. This legal framework created significant opportunities for sophisticated tax planning that Reinsdorf, with his combined expertise as both a CPA and tax attorney, was uniquely positioned to exploit.

Founding and Selling Balcor

In 1973, Reinsdorf sold his initial real estate business interests and formed Balcor Company, a real estate investment firm that raised $650 million to invest in buildings under construction. The company became hugely successful, specializing in sale-leaseback transactions and real estate syndications.

Key Balcor achievements:

- Raised over $650 million in investment capital

- Focused on commercial real estate development

- Pioneered innovative tax-advantaged real estate structures

- Built portfolio of properties across the United States

In 1982, Reinsdorf sold Balcor to Shearson Lehman Brothers (the investment banking and brokerage arm of American Express) for $102 million, equivalent to approximately $320 million in 2026 dollars. This sale provided the capital base that would enable his entry into sports ownership.

However, Reinsdorf continued serving as president of Balcor for several years after the sale, maintaining his involvement in the real estate industry even as he diversified into sports team ownership.

Purchasing the Chicago White Sox

In 1981, Reinsdorf made his first foray into professional sports ownership by purchasing the Chicago White Sox for $19 million.

The purchase was brokered by American National Bank, which arranged for a limited partnership structure. Reinsdorf led an investment group that included Eddie Einhorn, who became vice chairman and remained in that role until his death in 2016.

Soon after buying the White Sox, he signed star players Greg Luzinski and Carlton Fisk, tripled the team’s promotional budget, and increased scouting staff from 12 to 20 scouts. These investments paid immediate dividends, by the 1983 season, just two years after Reinsdorf’s purchase, the White Sox made the playoffs with the best record in Major League Baseball, their first playoff appearance since 1959.

The pinnacle of Reinsdorf’s White Sox ownership came in 2005 when the team won the World Series for the first time since 1917, an 88-year championship drought. This made Reinsdorf only the third owner in North American sports history to win championships in two different sports.

The Historic 2024 Season Disaster

In stark contrast to the 2005 championship, Reinsdorf’s White Sox suffered one of the worst seasons in Major League Baseball history in 2024, losing a modern MLB record 121 games with a winning percentage of just 25.3%. This historic failure intensified long-standing criticism of Reinsdorf’s ownership, with The New York Times describing him as an owner who “thinks he knows everything” and led the team to “historic disaster.”

White Sox Sale Agreement

In June 2025, after the disastrous 2024 season, Reinsdorf announced a long-term ownership agreement with billionaire investor Justin Ishbia. Under the agreement, Ishbia will invest and pay down team debt, with Reinsdorf having the option to sell his majority stake between 2029-2033. Beginning in 2034, Ishbia has the option to acquire controlling interest. The White Sox are currently valued at $1.8-1.9 billion.

Purchasing the Chicago Bulls

In 1985, Reinsdorf made his second major sports franchise purchase, acquiring the Chicago Bulls for $16 million as part of a syndicate, with his controlling stake costing $9.2 million for 56.8% ownership.

Reinsdorf’s timing proved fortuitous. Michael Jordan had been drafted by the Bulls in 1984, the year before Reinsdorf purchased the team. Under Reinsdorf’s ownership, Jordan would transform from promising rookie to global icon.

The Championship Dynasty

Under Reinsdorf’s ownership, the Bulls won six NBA Championships in eight years: 1991, 1992, 1993, 1996, 1997, and 1998. The team sold out every home game from November 20, 1987, through Jordan’s 1999 retirement.

General Manager Jerry Krause assembled one of the greatest teams in NBA history by drafting Scottie Pippen and Horace Grant, hiring Phil Jackson as coach, trading for Bill Cartwright, and signing Dennis Rodman, Toni Kukoč, and Ron Harper.

The Bulls became the NBA’s most profitable franchise under Reinsdorf’s ownership, earning $49 million in operating income in 2004 with a valuation of $356 million. As of 2026, the Bulls are valued at $5.8 billion, making Reinsdorf’s 40% stake worth approximately $2.3 billion, a 36,000% return on investment since 1985.

The Controversial Breakup of the Bulls Dynasty

The decision not to maintain the championship Bulls team after their sixth title in 1998 remains one of the most controversial episodes in sports history.

Fans and columnists accused Reinsdorf of breaking up the championship team, claiming they could have won more titles with Jordan, Pippen, Rodman, Grant, Kukoč, Harper, Armstrong, and coach Phil Jackson. Forbes described the breakup as “an example of owner greed.”

The reality was complex: Phil Jackson feuded with both Reinsdorf and GM Jerry Krause, and Jordan and Pippen were closely aligned with Jackson. According to the documentary “The Last Dance,” Krause told Jackson he wouldn’t be rehired even if the Bulls won the 1997-98 championship, reportedly saying, “I don’t care if it’s 82-and-0 this year, you’re fucking gone.”

However, Phil Jackson also declined a long-term contract offer from Reinsdorf in 1998, and Michael Jordan retired during the 1998-99 lockout, complicating the narrative of Reinsdorf simply dismantling the team.

Despite the controversy, Jordan and Reinsdorf maintained an amicable relationship. When Jordan retired to pursue baseball in 1994, Reinsdorf offered him a minor-league contract with the White Sox and continued paying Jordan his full $3 million NBA salary as a gesture of thanks.

Jerry Krause Net Worth and Legacy

Jerome Richard Krause (April 6, 1939 – March 21, 2017) was the Chicago Bulls general manager from 1985 to 2003, overseeing all six NBA championships. He won NBA Executive of the Year Awards in 1988 and 1996 and was posthumously inducted into the Basketball Hall of Fame in 2017.

At the time of his death in 2017, Jerry Krause’s net worth was estimated between $5 million and $20 million, with most sources settling around $5 million, modest compared to Reinsdorf’s billions, reflecting the difference between team ownership and executive management.

Krause remains controversial despite his success, credited as the architect of the Bulls’ dynasty yet blamed for breaking up the championship team. He died on March 21, 2017, at age 77 after struggling with osteomyelitis.

Michael Reinsdorf and Bulls Succession

Jerry Reinsdorf’s son Michael, 51, is the current president and Chief Operating Officer of the Chicago Bulls. After graduating from the University of Arizona, Michael initially worked in real estate and co-founded a stadium consulting company before joining the Bulls organization.

In 2010, Jerry asked Michael to manage the Bulls. Michael’s response: “Let me think about it, yes.” Since then, Michael has overseen all business operations and served as the Bulls’ alternate governor at NBA Board of Governors meetings.

However, Michael has faced criticism from Bulls fans for lacking qualifying experience, with the team “mostly sucking” during his tenure and sliding into irrelevance. The Bulls have paid the luxury tax only once (2012-13) under his watch despite Chicago being the third-largest market.

Unlike the White Sox, which Jerry plans to eventually sell, the Bulls are expected to remain in Reinsdorf family control, with Jerry expressing hope that his grandson will eventually own the team.

Reinsdorf’s Influence in Professional Sports

Donald Fehr, executive director of the Major League Baseball Players Association, called Reinsdorf “clearly the most powerful Major League Baseball owner” in the 1990s.

Reinsdorf’s power moves included stopping the sale of the Texas Rangers in 1988, influencing the Seattle Mariners sale, and being largely responsible for ousting Commissioner Fay Vincent in 1992. Alongside Bud Selig, Reinsdorf assumed baseball’s mantle of power in the early 1990s.

Reinsdorf developed a reputation as one of the most militant, anti-union, hardline owners in professional sports. Newsweek called him “one of the hardest heads in the 1994 baseball strike,” and he was described by Time as a “cheapskate.”

However, Reinsdorf was also instrumental in implementing major structural changes in sports economics, including NBA salary caps, revenue sharing in both leagues, and pioneering MLB internet revenue sharing through MLB Advanced Media (established 2000).

On April 4, 2016, Reinsdorf was elected to the Naismith Memorial Basketball Hall of Fame as a contributor, recognizing his impact on professional basketball, though the induction was controversial given his role in breaking up the championship team.

Charitable Work and Community Impact

Despite criticism, Reinsdorf has been involved in extensive charitable work through CharitaBulls and White Sox Charities, including donations to the Chicago Park District, funding for baseball and softball fields, and community development near the United Center.

In 2011, he received a Jefferson Award for “Greatest Public Service Benefiting the Disadvantaged.” He also serves as Life Trustee of Northwestern University and on numerous corporate and charitable boards.

FAQs About Jerry Reinsdorf Net Worth

Jerry Reinsdorf built his fortune through real estate investment, exploiting tax advantages from the Frank Lyon Supreme Court decision before selling his company Balcor for $102 million in 1982 and purchasing the Chicago White Sox and Bulls.

Yes, Jerry Reinsdorf still owns the Chicago Bulls with a controlling interest of approximately 40% as of 2026, with his son Michael serving as team president and COO.

Jerry Reinsdorf led a group that purchased the Chicago Bulls for $16 million in 1985, with his personal controlling stake costing $9.2 million.

As of 2026, the Chicago Bulls are valued at approximately $5.8 billion, making Jerry Reinsdorf’s 40% stake worth about $2.3 billion.

Final Thoughts

Jerry Reinsdorf’s net worth of $2.2 billion represents one of the most successful financial journeys in American sports history. From his humble beginnings as the son of a Brooklyn sewing machine salesman to becoming a billionaire owner of two major sports franchises, Reinsdorf embodies the American dream through talent, timing, and tenacity.

Yet his legacy remains deeply conflicted. The same man who presided over six Bulls championships and broke an 88-year White Sox championship drought is blamed for dismantling a dynasty and fielding the worst team in modern baseball history. The brilliant tax attorney who built a real estate fortune is criticized as a cheapskate unwilling to invest adequately in his teams.

This paradox defines Reinsdorf’s career: extraordinary financial success and championship glory paired with controversial decisions and fan alienation. His cost-conscious approach built massive personal wealth through franchise appreciation while frustrating fans who watched competitors outspend Chicago’s teams despite the city’s large market.

As Reinsdorf enters his 91st year, succession planning is underway. The White Sox will likely change hands within a decade, offering hope to long-suffering fans. The Bulls, however, appear destined for continued Reinsdorf family ownership under son Michael.

History will remember Jerry Reinsdorf as a complex figure, visionary businessman and championship owner on one hand, controversial penny-pincher and dynasty-breaker on the other. Both assessments contain truth, and both have contributed to building one of sports’ largest personal fortunes.